FundHunter

Leveling The Playing Field For Retail Traders

Access Institutional-Grade Data With Automated Analysis

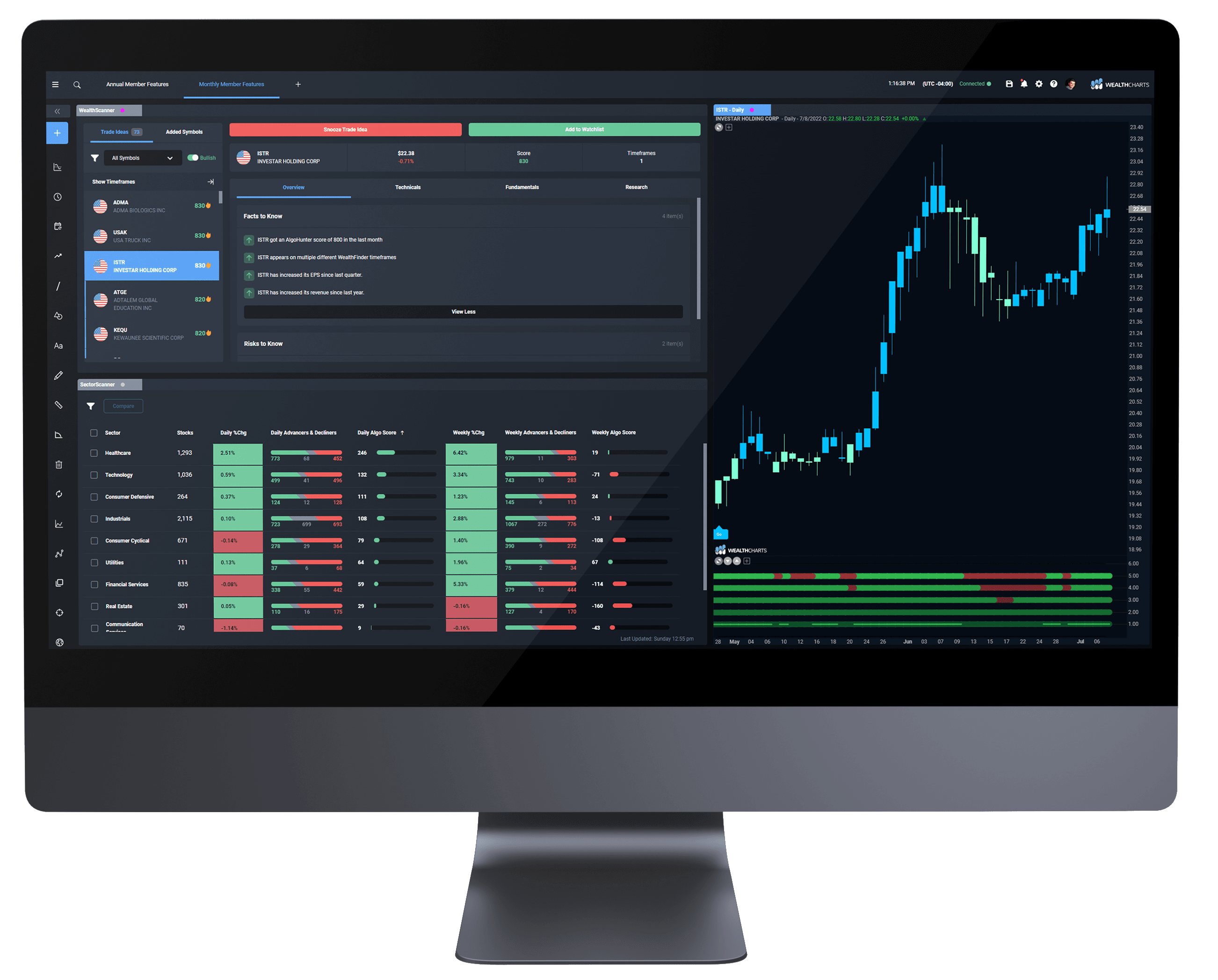

Do you ever feel like you can’t keep up with the huge amount of data and information in the markets and that trade opportunities are passing you by? It’s a common feeling for retail traders and one of the major advantages that institutions enjoy. Institutions have teams of analysts, programmers, and experienced traders that are all working to preserve their edge. Now you can level the playing field with FundHunter, the ideal tool for analyzing mountains of market data and then pairing the results with cutting edge technical analysis so that you can trade with the same tools that have previously only been available to hedge funds and institutions.

The Next Generation Of Trading Research, Analysis, And Execution Has Arrived, And It's Starting A Revolution

WealthCharts brings cutting-edge tools, competition tested strategies, and automated algorithmic analysis to retail traders - giving them every advantage possible when they need it most.

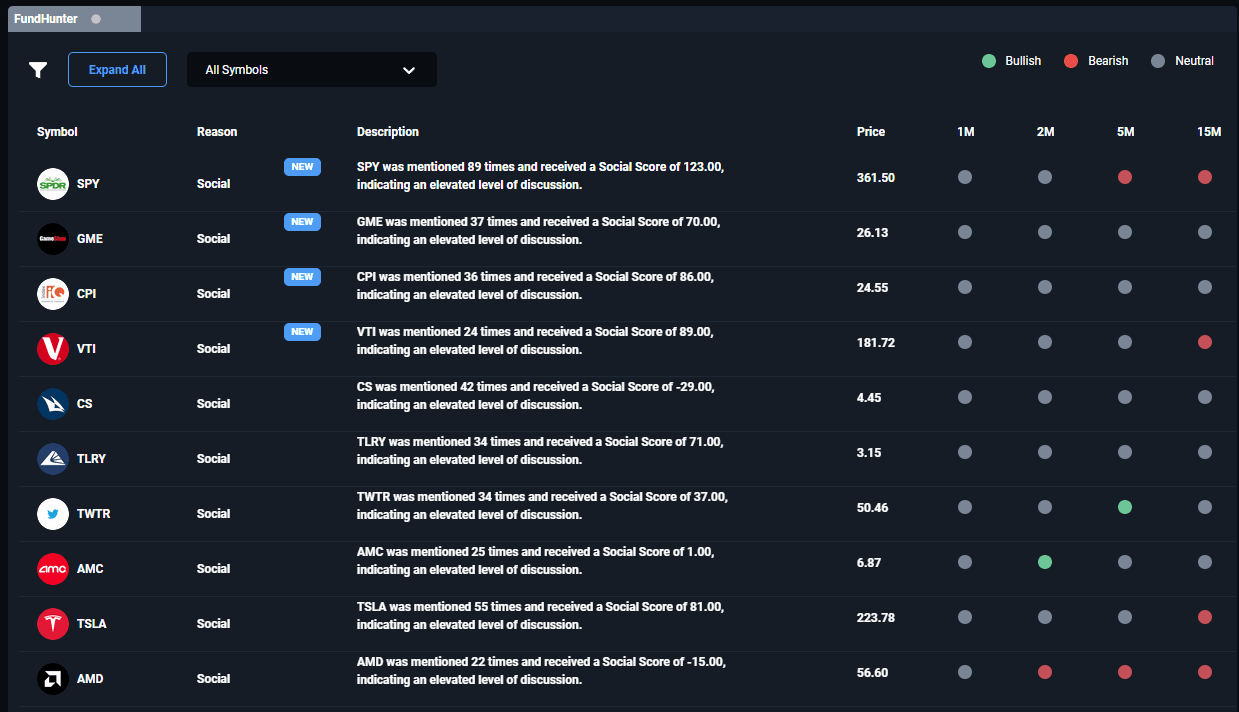

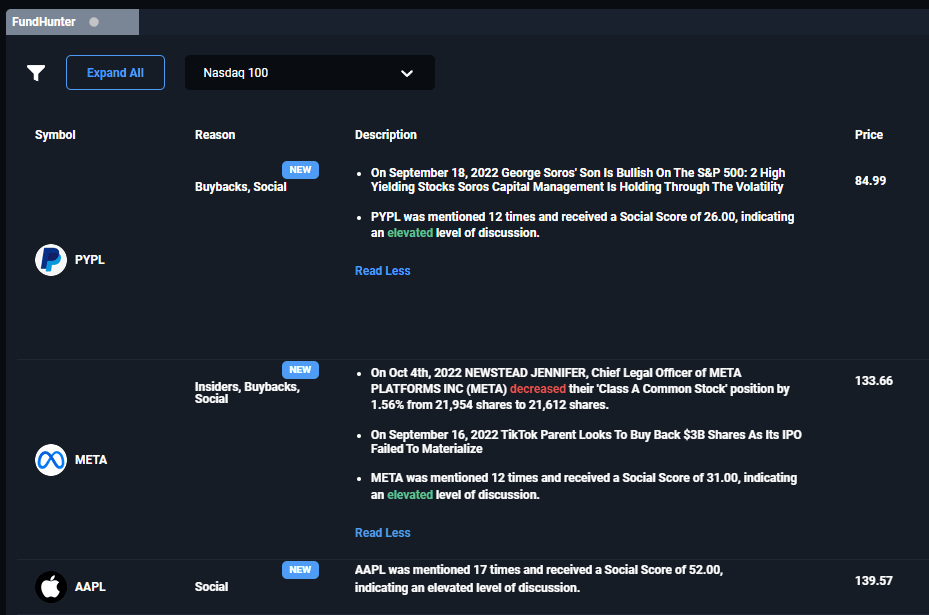

SOCIAL MEDIA ANALYSIS

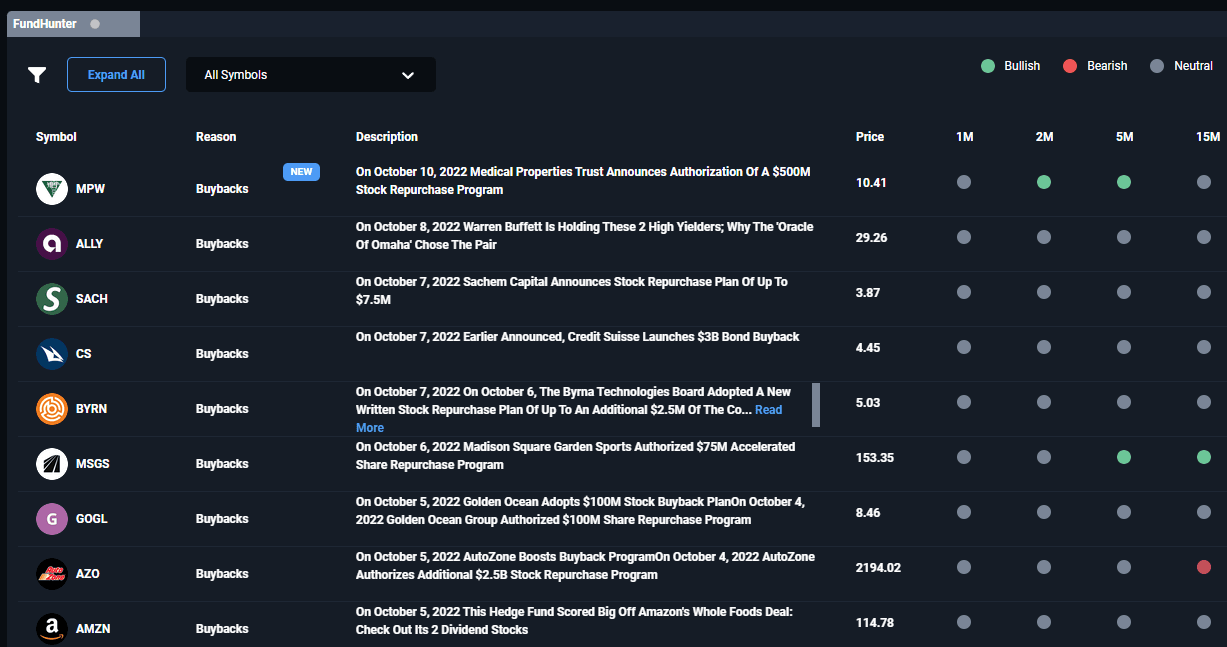

BUYBACKS

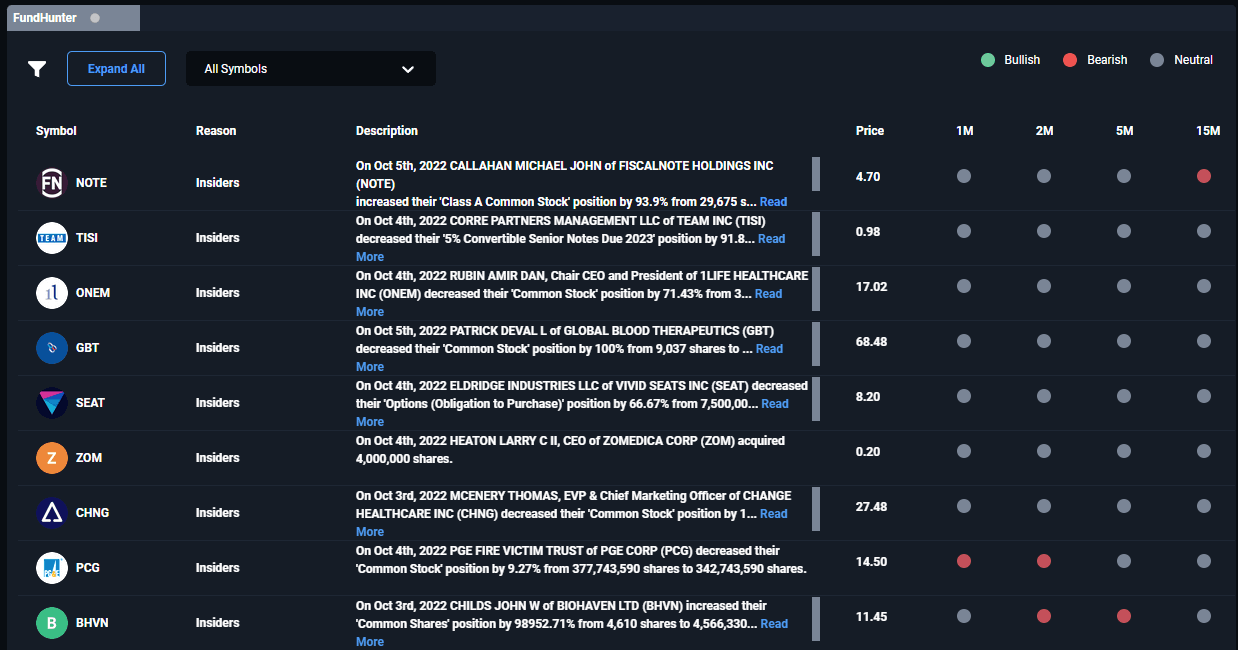

INSIDER BUYING & SELLING

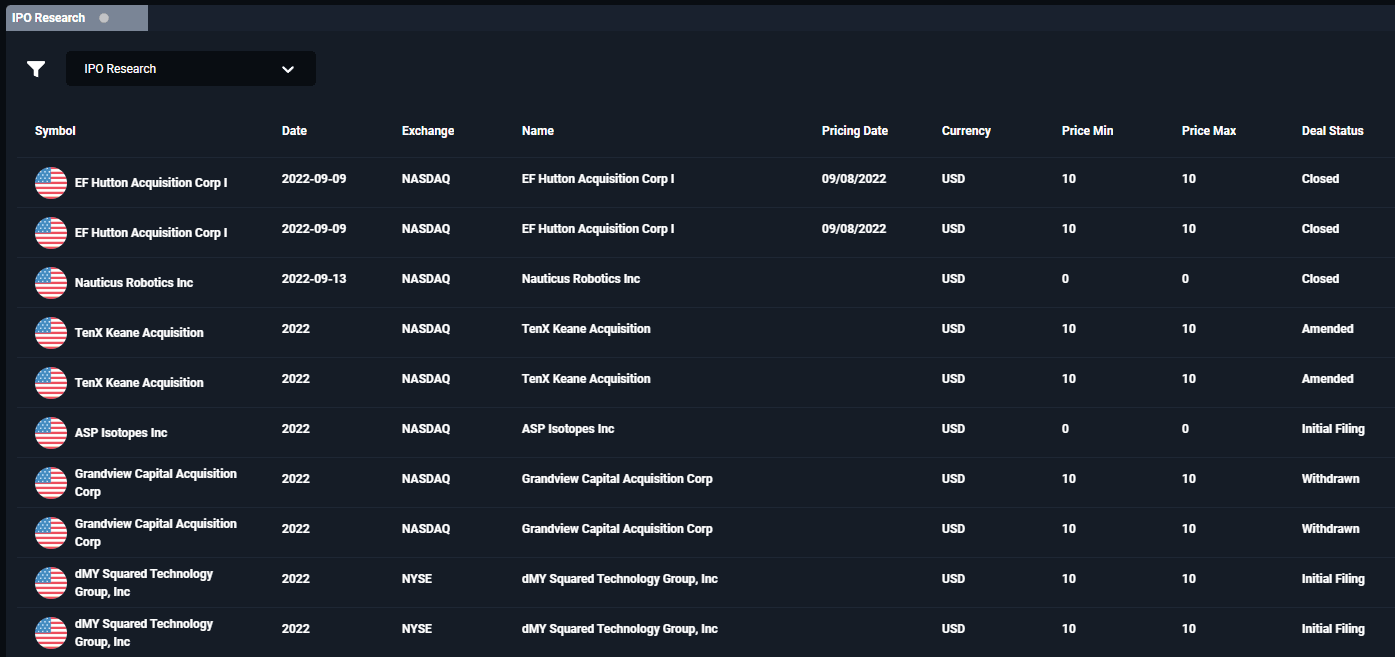

IPOs & SPACs

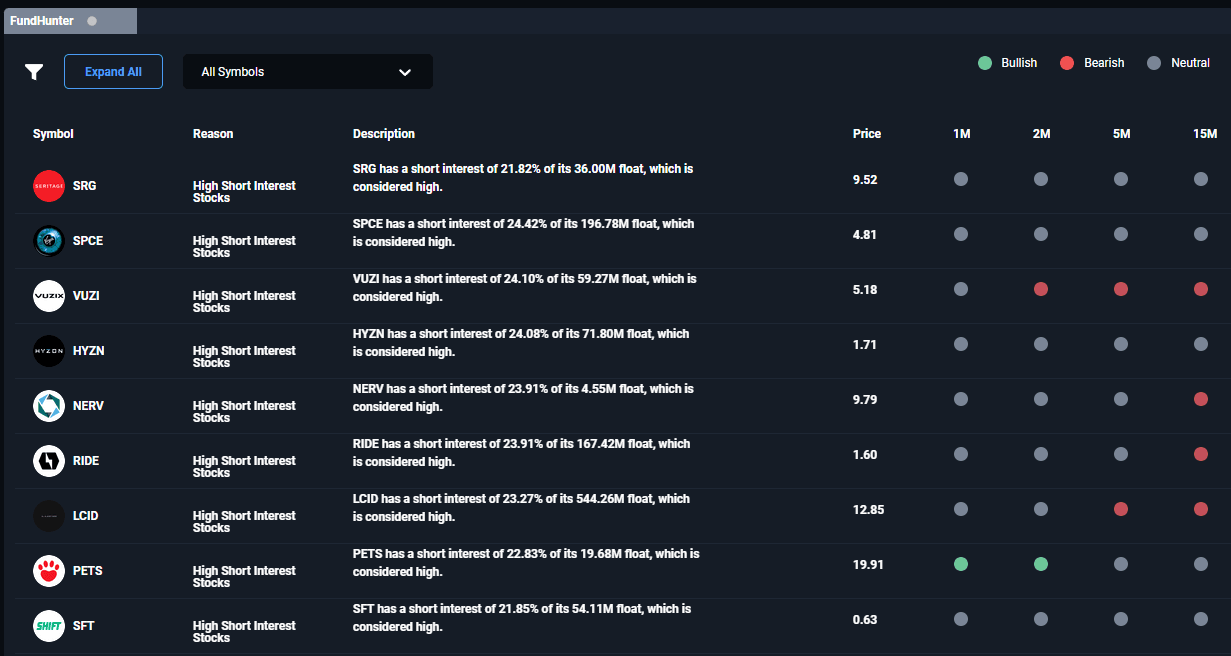

HIGH SHORT INTEREST

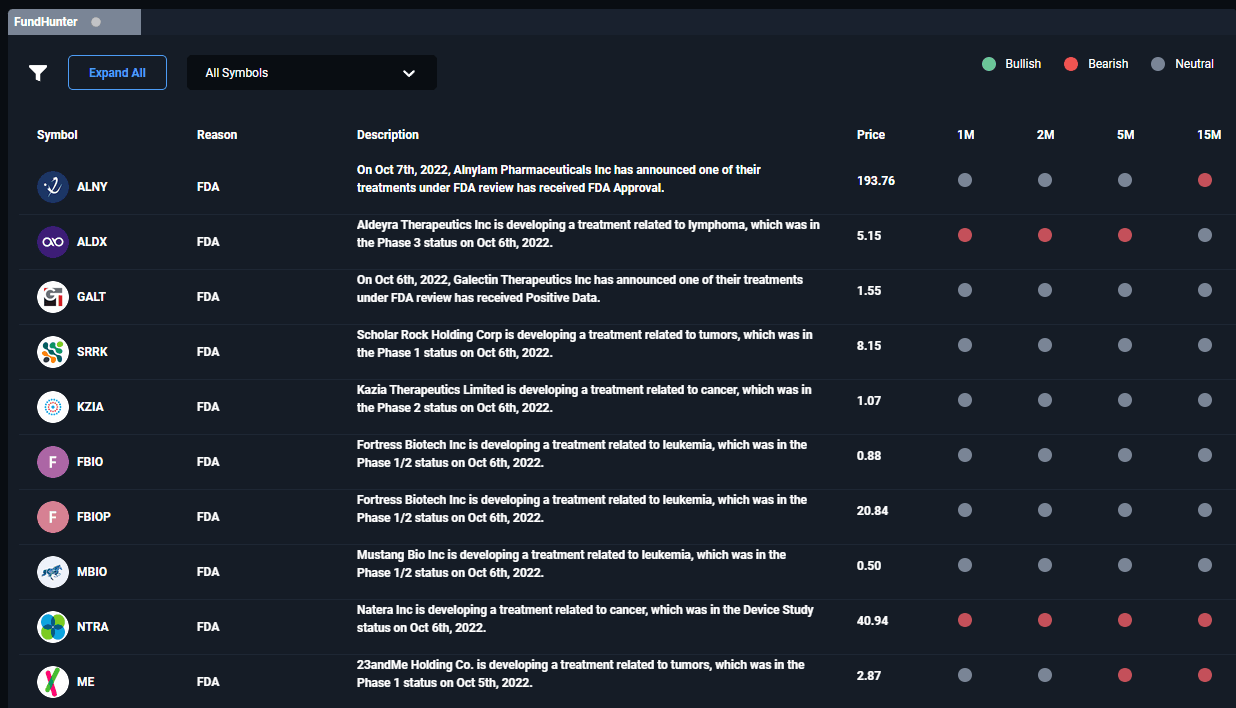

FDA ANNOUNCEMENTS

Find Trade Ideas With FundHunter

With These Three Straightforward Steps

Step 1: Determine What’s Important To You

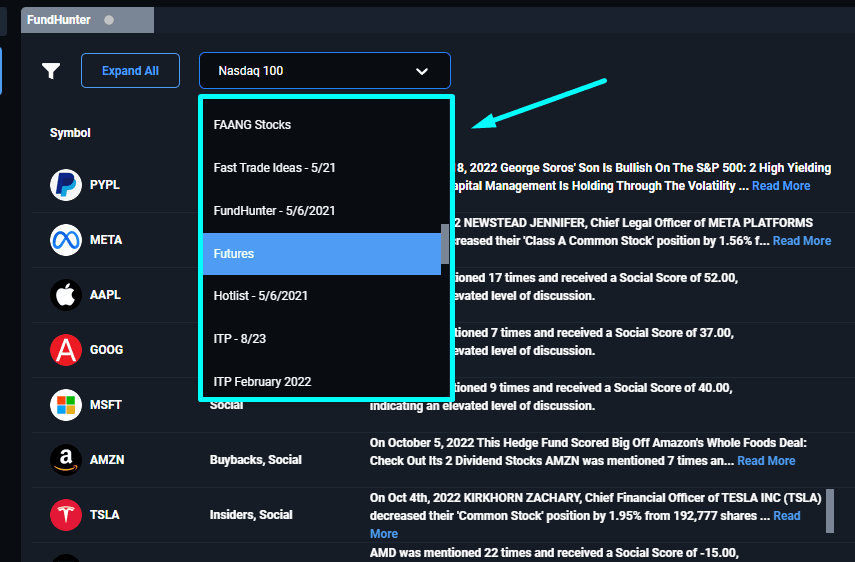

FundHunter can adapt to your trading style with just a couple clicks! Whether you like trading around company buybacks or you want to know the next meme stock blowing up on social media with high short interest, FundHunter will narrow your results and keep you focused on the opportunities that match your criteria.

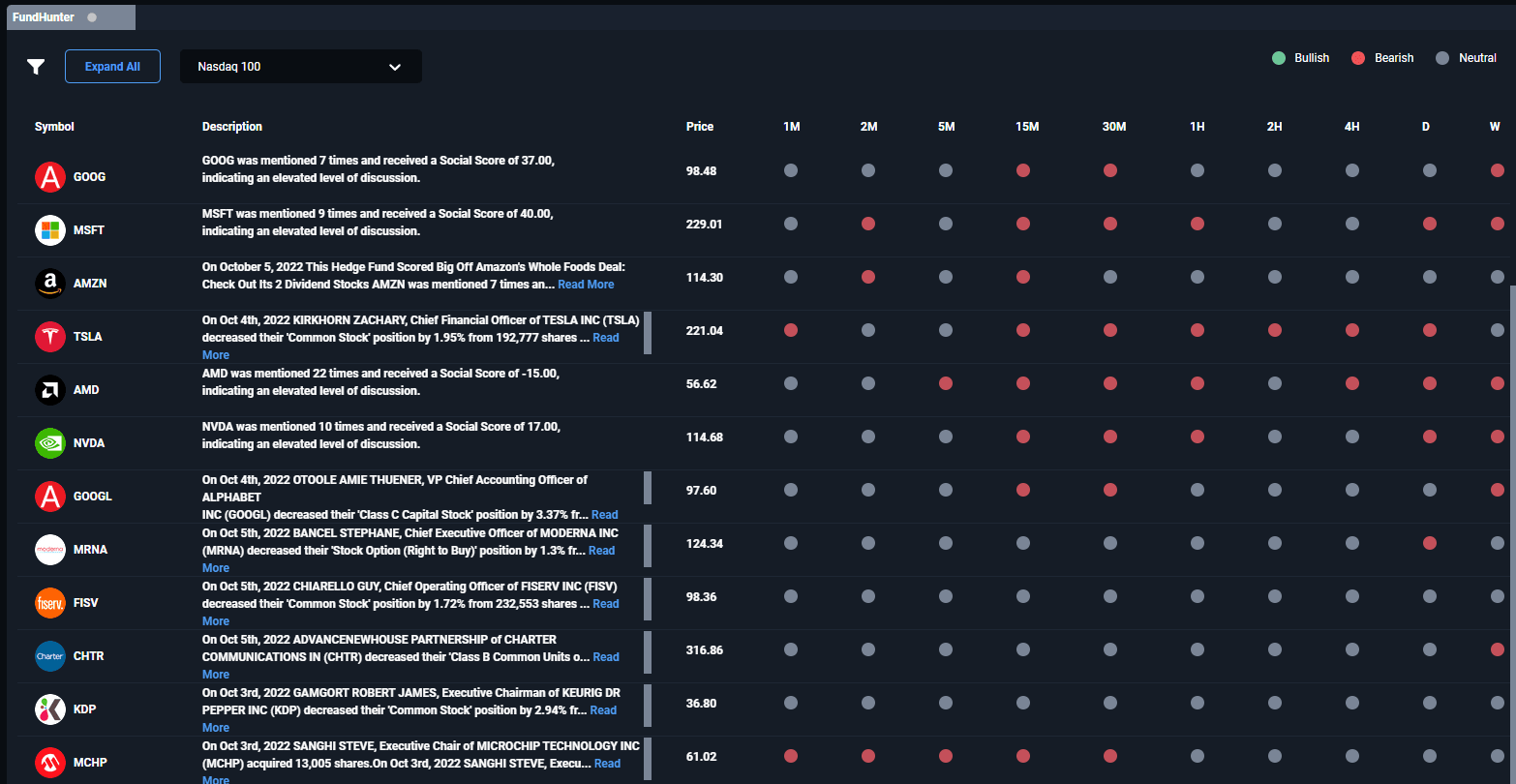

Step 2: Review Key Technical Insight For Your Trade Ideas

FundHunter has integrated technical analysis right into its results! After you have found a symbol you are interested in, you can scroll to the right to see multi-timeframe technical analysis signals, letting you know if the opportunity is bullish, bearish, or neutral for the timeframes you are interested in!

Step 3: Take It A Step Further!

In addition to scanning the major US markets, FundHunter can also be used to scan your existing watchlists! Select your watchlist from the dropdown menu and you’ll instantly see if any symbols you have been keeping an eye on have been experiencing any important insider buying and selling or other important signals!

Cutting-edge, Data-driven Discovery Paired with Powerful Technical Analysis Algorithms

FundHunter isn’t just a tool for highlighting interesting market data, it also determines the technical sentiment of each opportunity, saving active traders and investors hours of time spent researching and evaluating. You may not have a team of analysts, programmers, and all the other resources that institutions have, but with FundHunter, you won’t need them.