Categories

About UsHow to get startedAccount AccessBreakeven Stops, Manual Stops, and Trailing Stops

Ready to take your risk management to the next level? Watch the video or article below to create your own Breakeven, Manual, and Trailing Stops!

Prerequisites

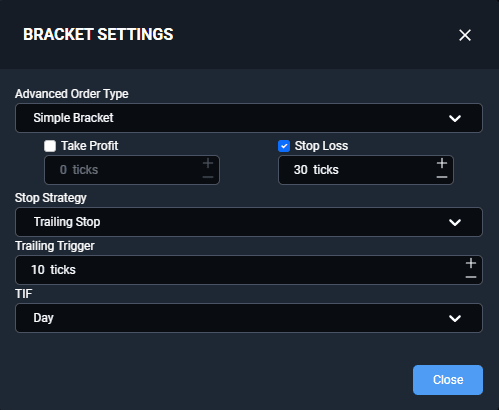

To access advanced stop features, make sure you're using an Advanced Order Type, available at the bottom of your order panel as seen on the screenshot above:

• Simple Bracket

• Multi Bracket

These order types allow you to set up automatic stop-loss and take-profit conditions.

Trailing Stops

What is a Trailing Stop?

A trailing stop is a stop-loss that automatically moves with the price when the trade goes in your favor. However, it remains fixed if the price starts moving against you. This helps lock in profits while still giving the trade room to breathe.

How to Set Up a Trailing Stop

1. Start with a bracket order that includes a stop-loss.

2. You may disable the take-profit if you want to focus only on the stop.

3. Set your initial Stop Loss (for example, 30 ticks below your entry price).

4. Define a trailing trigger - this is how far the trade must move in your favor before the stop begins to trail.

Example:

• Entry: Long position

• Stop-loss: 30 ticks below entry

• Trailing trigger: 10 ticks

Once the trade moves up 10 ticks, the stop will begin trailing 30 ticks behind the highest price reached.

Immediate Trailing Option

If you want the stop to start trailing immediately after you enter the trade:

• Set the trailing trigger to zero.

This means the stop will follow the market from the very beginning, maintaining the same set distance behind the highest (or lowest) price reached.

Note: The trailing stop only adjusts when the price moves in your favor. It does not tighten if the price retraces.

Break Even Stops

What is a Break Even Stop?

A break even stop moves your stop-loss to your entry price (or slightly above or below it) once the trade moves a certain amount in your favor. This helps ensure you don’t take a loss if the trade reverses.

How to Set Up a Break Even Stop

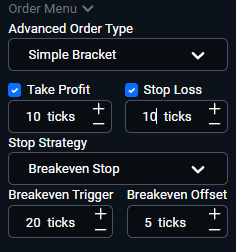

1. In your advanced order setup, select Break Even Stop under Stop Strategy.

2. Set two values:

Break Even Trigger: How far the trade must move in your favor before the stop moves.

Offset: How many ticks above (for long trades) or below (for short trades) the entry price the stop should be placed.

Example:

• Break Even Trigger: 20 ticks

• Offset: 5 ticks

Once the trade moves 20 ticks in your favor, the stop will move to 5 ticks above your entry price.

This approach allows you to lock in a small profit or cover fees and commissions.

Tip: If you set the break even trigger too low (e.g., 0 ticks), and the market isn’t moving, your trade may close immediately due to the stop activating right away.

Manual Adjustments

After the stop has been placed, you can manually adjust it by:

• Dragging it directly on the chart.

• Modifying it within the Trading DOM (Depth of Market) interface.

This allows you to:

• Tighten the stop manually as your trade becomes more profitable.

• React to changing market conditions without removing your automated setup.

Static or “Flat” Stop-Loss

What is a Static Stop?

A static stop (also referred to as a “nonstop strategy”) is a fixed stop-loss placed a specific number of ticks away from your entry. It doesn’t move unless you move it manually.

When to Use a Static Stop

Static stops are useful in:

• Highly volatile markets, to immediately protect your downside.

• Simpler trading strategies where you don’t want automation.

• Scenarios where you plan to actively monitor and manage the trade.

You can still drag and adjust a static stop during the trade as needed.

Using these tools effectively can help you protect trades, manage risk, and let profits run when the market moves in your favor. It may be best to test and practice with small positions or paper trading until you're confident in how each stop behaves.

Review related articles below on how to get started with Simple and Multi-bracket orders!